Companies wishing to join BME Growth must meet certain tranparency and reporting commitments as well as appointing two figures to help them in the process: the registered advisor and the liquidity provider.

Companies seeking admission to BME Growth must be public limited companies which meet the following requisites:

The criteria used by the Market to consider the adequacy of the shareholder diffusion of companies that request admission of their shares are:

-There must be at least 20 shareholders independent of the core shareholder or shareholders with stakes of less than 5% of the share capital.

-These shareholders do not include those with shares with a value of less than €10 thousand euros, except in cases where this is justified by mass retail distribution of more than 500 shareholders.

-Shareholders with shares worth more than €1 million euros are also not included.

Persons closely associated with any of the core shareholders, as defined in definition 26) of Article 3.1 of Regulation (EU) No. 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse, are also not considered suitable for consideration in the calculation of the diffusion. Consequently, other persons who are not within this definition shall be considered suitable for the purposes of computing the diffusion.

In addition, in the case of shareholders with an interest of more than €1 million euros representing less than 5% of the share capital, the portion exceeding €1 million euros shall not be considered for the purposes of calculating the total cash disbursed. Such shareholders will be computable for the purposes of the number of minority shareholders.

Based on previous experience, we estimate that approximately three to six months may elapse from the time a company appoints a Registered Advisor up until they are admitted to the Market.

The company must analyse what the process for listing on the market entails. With the help of its advisors, the company must ascertain how to leverage the opportunities offered by the securities market but it must also plan how to comply with legal requirements and factor in possible organisational changes and changes of mindset when listing and which investors assess in the share price.

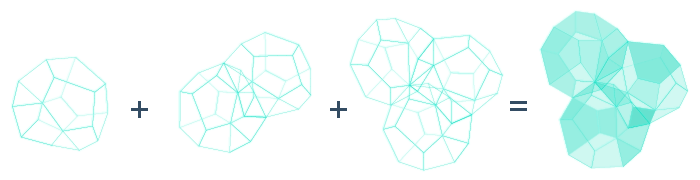

Depending on a company's situation and objectives, the design of its BME Growth listing operation will differ. Obviously, admission to the market via a listing, i.e. without a prior share sale, is different to a capital increase or an IPO (initial public offering).

When submitting the admission request, a company must include all documentation confirming it meets the listing requirements. It must also present the Document for Admission to the Market or, if applicable, the Prospectus filed with the CNMV. Here BME Growth can help and make it much easier, as drafts can be submitted and communication with the company and its Registered Advisor is fluid and ongoing.

Once the request and definitive documentation have been received, BME Growth shall assess the requisites and publish, if applicable, authorisation to be admitted. From that moment, if a share increase or a share offering is planned, the marketing phase among investors may commence.

Once the capital increase or share offering has concluded and, if applicable, the necessary documentation has been submitted, BME Growth will announce the listing in its Listing Bulletin, the security will be allocated a trading code and will be included in the Book Entry Register.

At 12am on the appointed day, the opening bell will be rung to signal the start of trading of the company on BME Growth.

Companies wishing to list on the BME Growth must first appoint a Registered Advisor.

These are specialists who assess whether a company is apt or not to join the MaB and who assist the company and check that it is complying with all the admission requirements, in particular, helping prepare the Information Document for Admission to BME Growth. Each company must appoint a Registered Advisor.

Trading is carried out using the same system as that in the Stock Market. The brokerage services for investors are also the same and are basically offered by the same members.

Companies wishing to list on BME Growth must designate a Liquidity Provider who is also a member of this market.

The main function of the Liquidity Provider is to ensure the liquidity of trades and achieve a sufficient trading frequency.

The Liquidity Provider will be totally independent to the company, and may not receive instructions regarding trades to be carried out on the market.

The Liquidity Provider agrees to hold buy and sell positions for a minimum cash amount that must be maintained during the session. This will allow the investor to have a certain counterparty to close the trades.

Companies listed on BME Growth must report, through their corresponding Registered Adviser, the following information to the market:

Periodical information

Insider information and other relevant information for investors

All the insider information and other relevant information communicated to the Market by the issuers of securities listed on or who have applied to be listed on the Market will be publicly disclosed by the Market, in accordance with the provisions of article 228.2 of the Spanish Securities Markets Law.

Other information to be reported:

Disclosure of information:

BME Growth applies a fixed rate of €6,000 plus a variable rate of 0.05 per thousand on the market capitalisation of all securities to be admitted based on the opening price on the Market. Thereafter, the fixed annual maintenance fee is €6,000.

Other costs:

The company must also bear in mind the costs applied by the Registered Advisor and the Liquidity Provider. In both cases these are negotiable and shall depend on the specific agreements signed.

If a capital increase/share placement is carried out, the underwriter will charge a commission depending on the size of the issuance and its characteristics.

BME GrowthFees

BME Growth has a free information service to help companies understand the admission procedure.

By email:bmegrowth@grupobme.es

· A half-yearly financial report equivalent to the entity's interim financial statements submitted, at least, to a limited review by its auditor, with a reference to the significant events occurring during the six-month period, within the four months following the end of the first six-month period of each year.

Annual information: audited annual financial statements released in the four months

What is BME Growth

Companies

Indices

News and Publications

Copyright © BME 2025. All rights reserved.

BME Growth

BME Growth